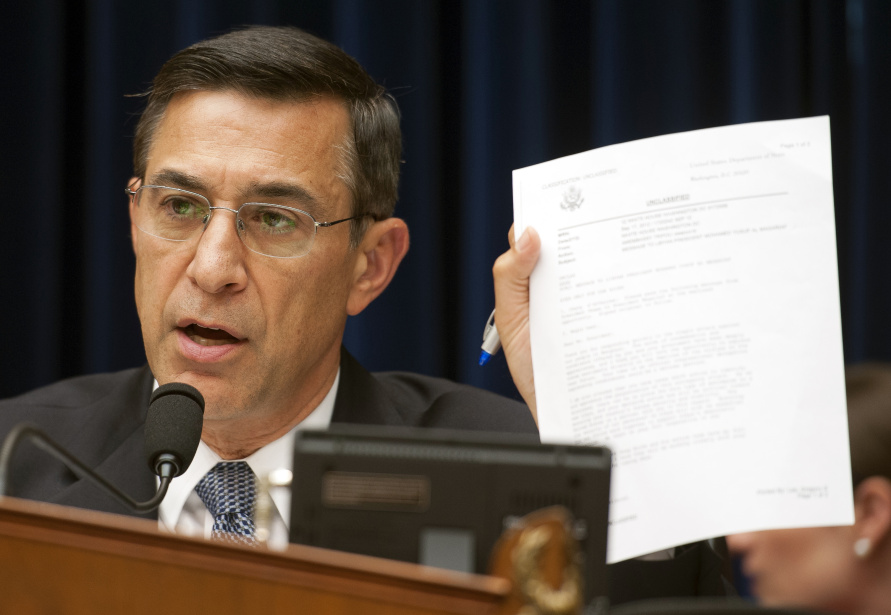

While Darrell Issa (pictured) and Congressional Republicans parade one witness after another up onto Capitol Hill to testify about the IRS’s targeting of conservative “social welfare” groups, a far more important discussion about the function of these sorts of organizations has fallen mostly silent.

Last month the Internal Revenue Service acknowledged an inappropriate imbalance in its screening process for 501(c)(4) organizations, which, by law, are prohibited from being involved in overt political activity, like backing or opposing specific candidates for office, or influencing elections.

But the nature of these groups has been so effectively muddied by the U.S. Supreme Court’s infamous Citizens United ruling that the IRS now has the unenviable task of determining which of these countless new groups genuinely deserve tax-exempt status, and which ones essentially function as an extension of a candidate’s or political party’s campaign apparatus.

| Any rational person can see these groups behave like political organizations. |

The IRS screwed up by implementing a filter utilizing certain keywords like “Patriot” or “Tea Party” to identify organizations for review while not using a comparable system for liberal groups. But its core instinct to be suspicious of these groups was defensible and entirely appropriate.

Although the Republican narrative suggests the IRS (and by extension the Obama White House) targeted political adversaries with no legitimacy, a closer examination of some of the specific conservative groups in question would cause any rational person unfamiliar with the eccentricities of federal election law to conclude these groups do in fact behave like political organizations, not social-welfare entities.

One Tea Party group from South Carolina that complained before Congress this week about the IRS’ unfair treatment clearly engages in local and national politics. The president of the organization openly attends political rallies and blasts out official press releases taking positions on specific political issues. Its website even has a prominent section entitled “Help stop ObamaCare” and the group co-sponsored a Republican presidential debate in 2011. But it claims to be non-political. Given the post-Citizens United murkiness that surrounds campaign finance laws, this type of activity might not have been illegal, but at the very least the IRS was well within reason to look more closely.

Prominent political figures and strategists on both sides have been able to exploit the Citizens United ruling, which allows these groups to spend as much as they want on political advertising without disclosing their donors. Most notable among these in the last election were Karl Rove’s Crossroads GPS, which ran ads for Republican candidates across the country, and Priorities USA, founded by former Obama aide Bill Burton, which spent heavily on ads to reelect President Obama.

The great tragedy of the IRS’s ineptitude in handling this issue is that it has allowed an image to emerge of an out-of-control government and ruthless administration that employs Nixonian tactics to destroy its enemies. The Tea Party’s favorability numbers have even begun to climb a bit in the last few weeks, presumably a display of sympathy for a group of people who are viewed as victims now.

| This is really about political organizations gaming a broken system so they don’t have to pay taxes. |

But this is really about political organizations gaming a broken system so they don’t have to pay taxes, and an IRS that has, if anything, not been nearly aggressive enough in enforcing the regulation of these groups.

Unfortunately, the IRS, which wasn’t winning any popularity contests to begin with, has botched the handling of this so horribly that the agency has done tremendous damage to what credibility it did have. In the future, it’s likely there will be a level of squeamishness on the part of the IRS to diligently scrutinize these types of applications, and that is exactly the wrong reaction to the abundance of new groups popping up.

There’s no question it was wrong to disproportionately focus on conservative groups and not be equally demanding of progressive organizations. But the filtering mechanisms actually were quite effective, and it’s difficult to find an example of a group flagged by the filter that isn’t, by any objective standard, overtly political.

If Citizens United is the law of the land, and secret money can flow into our political system now with comically inadequate oversight for the most part, increased scrutiny by the IRS would be a very welcomed development.

Sadly, because of this fiasco, the IRS has forfeited its moral authority for a while, and groups like Karl Rove’s will continue to be placed in the same “social welfare” category as organizations like volunteer fire departments.

Doug Daniels, a freelance journalist, is a former staff reporter for Campaigns & Elections. He is the author of the forthcoming memoir Sifting Through the Wreckage.

0 Comments