To submit your Letter to the Editor, email us at [email protected]

The Danger of “Preventive” War in Iran

PHOTO: Daniel Torok

June 23, 2025

To the Editor:

White House claims about the supposed success of US bombing in Iran are highly uncertain, but there is no doubt that unprovoked US and Israeli military strikes against Iran are a direct violation of international law. Article 2, (4) of the UN Charter prohibits states from using military force against other states without the approval of the Security Council, except for self-defense. States may use force to defend themselves when they are under attack by an aggressor, as Ukraine is doing, but that is not the case in this instance. Israel was not under attack when it began military action nearly two weeks ago. Iran did not use force first or threaten to do so.

The United States claims that its attack against Iran is justified as a preventive measure to stop the Tehran government from developing nuclear weapons. Israel has used similar arguments, claiming that military action is necessary to avoid a future Iranian nuclear attack.

The principle of preventive war in international law is not widely recognized, and if applied must be strictly conditioned. Preemptive action may be permissible if a country is responding to an imminent threat of attack, according to historical standards, but only if the threat of aggression is “instant, overwhelming, leaving no choice of means, and no moment for deliberation.”

These conditions clearly do not exist in reference to Iran, which has accelerated its enrichment program but does not yet have a nuclear weapon. Prior to the US attack, the White House claimed that Iran could produce a bomb “within a couple of weeks.” Mossad, the Israeli intelligence agency, asserted that Iran would need only 15 days to achieve a nuclear weapon. US intelligence agencies assessed in March, however, that Iran had not yet made a decision to build a nuclear weapon.

Iran’s stockpile of higher enriched uranium has been growing at an alarming rate, prompting the International Atomic Energy Agency to declare the country in breach of its nonproliferation obligations. Enriched uranium per se is not an immediate weapons threat. As Kelsey Davenport of the Arms Control Association has observed, if Iranian officials decided to create a bomb, it would take up to a year to convert its enriched uranium into metallic form and create an explosive device. The threat of an Iranian bomb is serious but not “instant” or “overwhelming.”

The preemption justification also fails because alternative means for addressing the threat have been available and were actively underway. Tehran was engaged in negotiations with Washington to restrict its nuclear program when the Israeli attacks began. As the US threatened to bomb, Iran sent urgent signals indicating its willingness to return to the bargaining table. Deliberations for possible diplomatic solutions were underway as the bombs began to fall.

The use of force is not an effective means of preventing nuclear proliferation. On the contrary, the current Israeli and US armed assault could create the very danger it is intended to prevent. Senior US intelligence officials warned before the strikes began that attacking Iran’s nuclear sites would likely shift Tehran toward producing a bomb. On Monday, June 17, soon after the first Israeli strikes, the Iranian parliament introduced a bill that—if passed—could see Iran withdraw from the Nuclear Non-Proliferation Treaty. The humiliation of being attacked by the US and Israel may convince Iranians that acquiring nuclear weapons capability is necessary to deter similar aggression in the future.

Most nonproliferation successes have been the result of negotiated agreements, not the use of force. South Africa, Libya, Argentina, Brazil, Ukraine, Kazakhstan, and other states gave up the bomb or terminated nuclear development through negotiated agreements that provided security assurances, sanctions relief, and the promise of global economic integration.

In 2015 Iran negotiated an agreement with the US, the UK, Russia, China, France, and Germany for major reductions in its nuclear program, including unprecedented levels of intrusive verification. Iran was implementing the deal fully when the first Trump administration reneged on the agreement in 2018 and reimposed coercive sanctions. This prompted Iran to resume and intensify uranium enrichment. The US renunciation of the 2015 agreement set in motion a negative action-reaction cycle that has led to the current crisis.

US and Israeli attacks certainly caused severe damage to Iran’s nuclear facilities. US bombs reportedly hit uranium enrichment sites in hardened, subterranean facilities. The President claims that Iran’s nuclear program is “obliterated,” but that is extremely doubtful. Nuclear materials were being removed from production sites prior to the bombing. James Acton observes that Iran retains a large stockpile of centrifuge components. He estimates Iran could reconstitute its nuclear program rapidly, perhaps within a year. US and Israel bombing raids can physical facilities, but they cannot eliminate the breadth of scientific and technical knowledge acquired in Iran during decades of advanced nuclear development. If Iran decides to build a bomb it will find a way.

Israel’s lawless military attacks against Iran come in the context of the Netanyahu government’s violations of international law in Gaza. Israel was justified in defending itself against Hamas’ terrorist attacks on October 7, 2023, but the military occupation and often indiscriminate use of force in Gaza have taken the lives of more than 50,000 Palestinians, including thousands of civilians. The homes and livelihoods of more than a million people have been devastated.

The International Criminal Court declared in July 2024 that Israel’s continued occupation of Gaza was unlawful. Human Rights Watch has described Israel’s denial of humanitarian assistance to Palestinians in Gaza as a flagrant violation of international humanitarian law. Former Israeli Prime Minister Ehud Olmert has written that Israel is committing war crimes in Gaza.

The US has turned Israel’s illegal war into an American war. For many in Washington the use of force against Iran is seen as an act of support for Israel, but the conflict is leading to greater isolation for Israel and the loss of potential allies among nations in the region.

The United States is and always has been a friend of Israel, but the commitment to support a friend should not extend to complicity in illegal acts. When a partner goes astray, a friend steps in to help them get back on course. The United States has failed in that duty, doubling down on the illegal use of force and launching a war that is likely to have catastrophic consequences for Israel and the Middle East region.

David Cortright is a professor emeritus at Notre Dame’s Keough School of Global Affairs and a visiting scholar at Cornell’s Reppy Institute for Peace and Conflict Studies. He is the author of more than 20 books on peace and nuclear disarmament issues.

Jimmy Carter & the Merits of “Introspection”

PHOTO: Jimmy Carter Presidential Library

To the editor,

Few, even among his detractors, will deny that Jimmy Carter was a man of consummate good character and personal integrity — before, during, and after he was president. He was indeed just that, even though opinions will differ significantly over his presidency — the many encomia at the time of his death notwithstanding.

Given his passing, I relistened to President Carter’s most famous speech, delivered on July 15, 1979. It was titled the “Crisis in Confidence” speech, although it became somewhat derisively known as the “Malaise” speech. And despite the President’s best intentions, it was received that way: an iconic statement of the nation’s malaise – particularly, Carter’s perception of it. In it, the President basically attempted to examine what was wrong in America. Perhaps more importantly, however, he detailed what he came to perceive was wrong with his own stewardship of the nation. In a word, although he didn’t use it, he and his Administration were doing the job “poorly”, and he expressed his intention to fundamentally self-correct.

Despite my unbending admiration of his character, no president of the United States will ever again give such a speech. Nor should they. Leaders must speak with confidence about what they’ve done, what they’re doing, and what they plan to do. That is, if they hope to maintain their job and register a favorable place in history.

Carter instead told us — indeed, admitted — that the country was in paralysis, and drifting. And, reading between the lines, that he was at fault. What good could have resulted from making this public statement? Indeed, many believe that speech so deep into his presidency — perhaps even more so than the Iranian Hostage Crisis given its apparent “negativity” — cost him his re-election bid in November, 1980 because the public perceived his own lack of confidence.

Let’s look at it differently, however, concentrating on the first ten minutes of the speech. There one learns something altogether unique about President Carter and what he chose to do. For as he explained in detail, over the ten days preceding his speech he had invited citizens from all walks of life to meet with him one on one at Camp David and afterwards. In those sessions, he asked each to tell him from their individual perspectives why things had been going wrong. Make no mistake, they did.

One offered, “you are not leading this nation – you’re just managing the government.” Another, “you don’t see the people enough anymore.” A third, “we’re in trouble. Talk to us about blood sweat and tears.” And yes, “the big shots are not the only ones who are important.” If those broadsides were not enough, as he himself summarized it, “the erosion of our confidence in the future is threatening to destroy the social and political fabric of America.” Ergo, the “crisis in confidence” as he himself labelled it. And who would be to blame for that crisis?

You and I have never been president. Still, none of us has ever invited others – critics or even well-wishers — to an intervention of us, where we urge them to tell us “What’s wrong with me and how I have conducted myself,” personally or professionally? No leader ever does. Yet here, the popularly elected president chose to do precisely that. Noble, indeed. And it would have been fine had the President simply internalized all that and acted accordingly.

Unfortunately, though, Carter didn’t stop there. He chose to tell the American people exactly what these (call them) “intervention guests” had confidentially told him. Yes, candidate Carter had told us that he would “never lie to the American people.” But he never said he would tell America exactly what guidance he would receive from private critics.

Here, though, he was doing precisely that. In fact, seated in the Oval Office looking directly into the camera he read from the notes he took of the conversations with those whose critique he had sought. It was a bad idea, to be sure (“Yeah, that confidante was right. Why didn’t Carter consider that 2 and ½ years ago?”). Yet Carter did it with candor. Importantly, he demonstrated the personal integrity of a solicited “introspection” – where he attempted to get to the bottom of what he needed to do going forward. When I listened to that speech in 1979, I didn’t appreciate the strength of character needed by a president to look deeply within himself in the way he did.

In a recent essay about the famed baseball player Pete Rose, who had been banned from baseball due to his gambling and later unwillingness to acknowledge it, The New York Times said that Rose was “allergic to introspection and undaunted by fact.” An intriguing phrase representing the antithesis of President Carter and the manner in which he chose to address personal crisis. It is an allergy from which many of us suffer. Carter, though, wasn’t plagued by it, or undaunted by learning the facts. Carter actually invited the introspection that he received.

This isn’t a reverie concerning the merits of the Carter presidency. Rather, it’s an effort to critique the character of a man who urgently wanted to do “better”. Yes, Carter won’t be listed among America’s greatest presidents. But even though his “Crisis in Confidence” speech is remembered in failing terms, his sincere effort to learn everything possible from across the spectrum of America in order to do better – accomplished through what must have truly been a painful process of introspection — reveals a character trait from which we all can learn.

RIP Mr. President!

Joel Cohen practices white collar criminal law as Senior Counsel at Petrillo Klein & Boxer. He is an adjunct professor at both Fordham and Cardozo Law Schools.

To the Editor:

It’s a noble effort to make such a distinction, but to the people, fascism and patriotism are just buzzwords. The electorate speaks in kitchen-table issues and simple narratives, not political jargon- which holds no weight to them. Public distrust and discontent has eroded everything from their belief in government to the power of words. If Trump gets called a fascist, it won’t mean anything to the ones who say they want better gas prices and who think Biden is just as bad as him. It’s all just a bunch of loud noise to them, and luckily for them, they were born deaf to the dying gasps of the country that gave them shelter and sustenance.

Fascism only works because of the masses that turn off their minds and close off their hearts to listen to the sweet lies of selfish men. The media and the state can only do so much to combat this existential threat, because it’s a problem of the people, and only people can solve it. To give them a push, we have to confront them and their ideologies in ways that don’t make them go deeper into the rabbit hole. The goal behind both calling Trump a fascist and talking to people on common ground is the same: to shake them free of easy answers like “both sides are the same.” But only one of those methods is subtle- and for all the sensationalism politics brings with it, subtlety might just be what we need.

Amaan Bhimani

Atlanta, GA

January 19, 2024

To the Editor:

Re: Dancing in the Dark: Steps to Avoid a Constitutional Coup in the 2024 Election

This great article on concrete steps to avoid unconventional threats to a valid and trusted election in 2024 is extremely important. This article is the only effort I know of that warns and prepares us for the unexpected but possible coup against American democracy.

Dick Gephardt, former Majority Leader, US House of Representatives, currently working with Save our Republic, a bi-partisan effort to defend democracy.

January 9, 2024

To the Editor:

Re: Dancing in the Dark: Steps to Avoid a Constitutional Coup in the 2024 Election

Amazing piece of legal and Constitutional analysis. Extremely lucid explanations of complex hypothetical election scenarios. Well done Medish and McCleary! There is, as you show, ample room for bad faith to upend our democracy. We are left trembling.

John Perkins

March 9, 2023

To the Editor:

Holtec International, the firm responsible for decommissioning the Indian Point nuclear power plant, has stated that it will resume discharging radioactive wastewater into the Hudson River as early as August, and possibly sooner.

New legislation introduced by Senator Harckham and Assemblymember Levenberg, with the support of a growing list of co-sponsors, will put a stop to any radioactive discharges into the Hudson River. We need to make this bill a law before Holtec resumes the release of radioactive waste from Indian Point into the Hudson River. Legislators need to hear from you – click here to tell our representatives you support this important bill.

Instead of discharging the wastewater, Riverkeeper is calling for secure storage of the contaminated water on site while safer disposal methods are evaluated. It’s time to draw the line against using the Hudson as a dumping ground for tritium, a radioactive isotope found in the spent fuel pools. Ingestion of tritium is linked to cancer, and children and pregnant women are most vulnerable.

A groundswell of public voices are objecting to Holtec’s discharges that prioritize profit margins and expediency over the Hudson River, and local communities. Riverkeeper supports this call to explore safer alternatives to dispose of the tritium contaminated water.

Carolyn Marks Blackwood

Rhinecliff, New York

To the Editor:

Re: Justice Thomas Should Take a Long Look in the Mirror, by Jesse Wegman, New

York Times, May 15, 2022

Looking into the mirror won’t help Clarence Thomas. He is a hopeless Uncle Tom, a

stooge for white conservatives and a hypocrite. The depths of his hypocrisy can be

seen when one considers that he grew up in segregated Pinpoint, Georgia at a time

when Georgia crackers did all they could to suppress and dehumanize black folk.

However, he was fortunate to come along in an era when black civil rights pioneers had

paved the way for more open minority college admissions (affirmative action), and he

was admitted to Holy Cross and later to Yale Law School.

But for affirmative action, Thomas would have had little chance of admission to Holy

Cross and no chance of admission to Yale Law School where he admittedly struggled.

His Yale Law School credential nonetheless likely helped him win important Republican

sponsorship for senior government positions, culminating in a US Supreme Court seat.

Thomas was thus a classic beneficiary of affirmative action. Even he has admitted

that.

He escaped the poverty and racial oppression of his youth and obtained a first-rate

education; yet instead of using his good fortune to help other young black folk achieve

the same opportunities that he had, Thomas shamelessly became an arch enemy of

affirmative action and a water carrier for white conservatives who seek to turn back the

clock on black educational and career progress, women’s reproductive choice, black

voting access and the like. And he’s apparently so much under the influence of white

conservatives that he’s failed to take action to temper his wife’s participation in extreme

right wing causes—her high-profile advocacy has already created the appearance of a

conflict of interest for him and will continue to do so as January 6 and other

conservative pet peeve cases come before the Supreme Court.

Clarence Thomas, whom I long ago dubbed Uncle Thomas, has thus taken Uncle

Tomism to new heights. He’s shown no evidence of having black pride or a sense of

the myriad struggles that black folk and women have suffered through in this country.

What he has shown is self-hate and hopeless attempts to whitewash himself and

escape his racial identity. The problem is that he can run but he can’t hide. Mirrors

don’t lie. So long as he doesn’t respect himself, white conservatives won’t respect him

either. And that likely includes his wife. They’ll just shamelessly use him as a hapless

pawn to further their narrow political interests.

James T. Breedlove

Philadelphia, PA

Unquiet Flows the Don

To the editor,

After Vladimir Putin seized the Crimea in 2014, he tried to shift blame for its woes on to Ukraine. He made the case that, by virtue of long occupation—Crimea was taken from the Ottomans in 1783 by Catharine the Great and defended by Nicholas the First in the Crimean War—the temperate peninsula was as Russian as Tolstoy or Red Square.

His PR campaign began not with kind words to Crimea’s Ukrainians, but by making Tatar Crimea’s official second Language. Because, in 1941, in a prequel to ethnic cleansing in the Balkans, Stalin deported the Crimean Tatars. A quarter of them died on the road to Uzbekistan and the survivors were kept in exile for a generation.

Could Ukrainians in the recently occupied territories also end up as strangers in their own land? Putin speaks of Russians Great, White, and Little, but his Soviet nostalgia hardly extends to many of its “Autonomous Republics.” The ethnic solidarity of Tatarstan, not far east of Moscow, is signaled by apartment towers with brick prayer rug facades facing Mecca. In 2014 Putin acknowledged the second language of the back streets of Sevastopol, but not the nationhood of its speakers.

The Russo-Ukrainian divide runs deeper than dialect. Rivers are two-way streets, and in the first millennium river trade connected the Kievan Rus to Northern Russia’s principalities. But proximity to Byzantium led to Kyiv’s conversion to Greek Orthodoxy long before the Baltic North. Not until 1253 were all the Russias united in the person of Alexander Nevsky, Prince of Novgorod and Grand Prince of Kiev.

Putin turned his nation into a natural gas station with a growing line of anxious customers, Ukraine among them—the closer to Russia, the colder the winter and the greater the political leverage the supply of Russian gas affords. Nor is this the Ukraine’s commodity exchange debut. The rich chernozem soil of its plains long made it the breadbasket of Europe. The flow of wheat barges down the Dnieper modulated the price of bread in 19th century Paris much as trans-Ukrainian gas pipeline flow rates move energy futures today.

There is also more to Ukraine’s energy story than fossil fuel. Just as America tried to build its way out of the Great Depression with the Tennessee Valley Authority and the Hoover Dam, Soviet planners tried to use hydropower to leverage post-revolutionary economic growth. In 1927, Stalin broke ground near Kiev, for a series of massive dams descending the Dnieper to the Black Sea in a five-step cascade that still dwarfs the TVA.

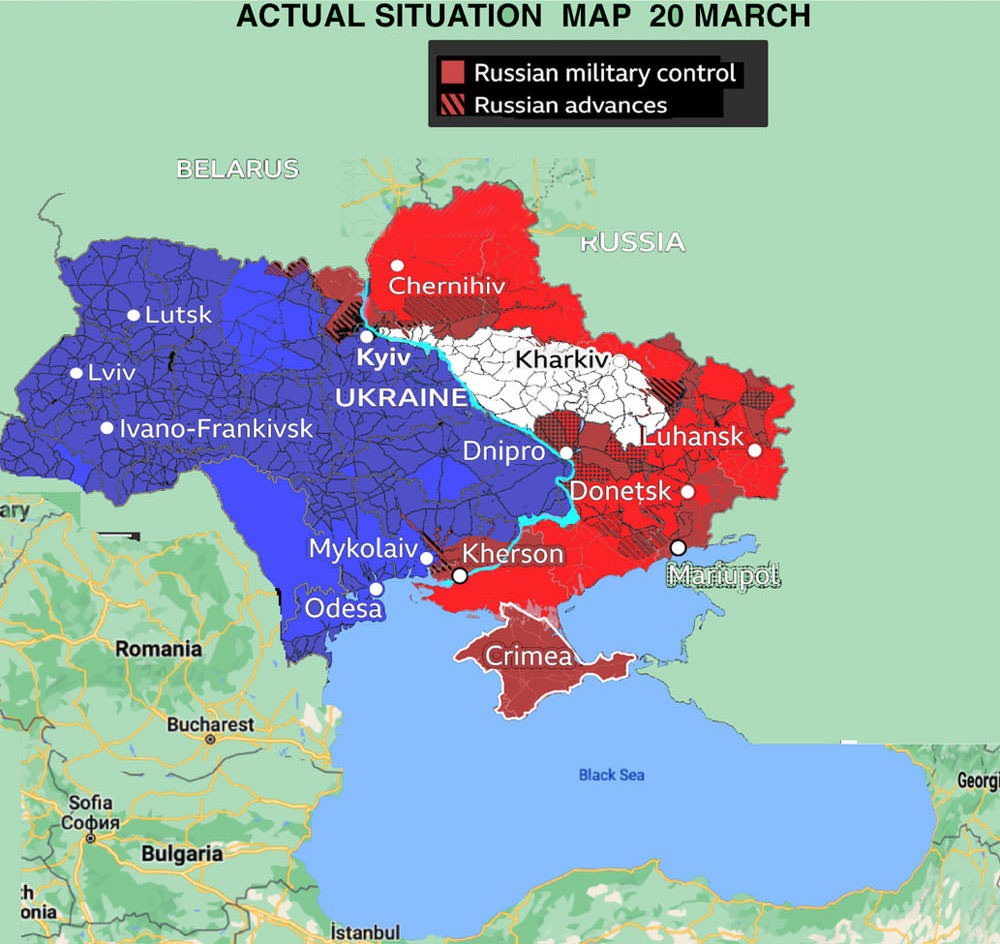

A satellite image of the Ukraine plainly shows the results. A thousand-mile stretch of the Dnieper now consists of broad reservoirs rising behind hydroelectric dams so high that should one fail, a virtual tsunami could roll downriver to the Black Sea.

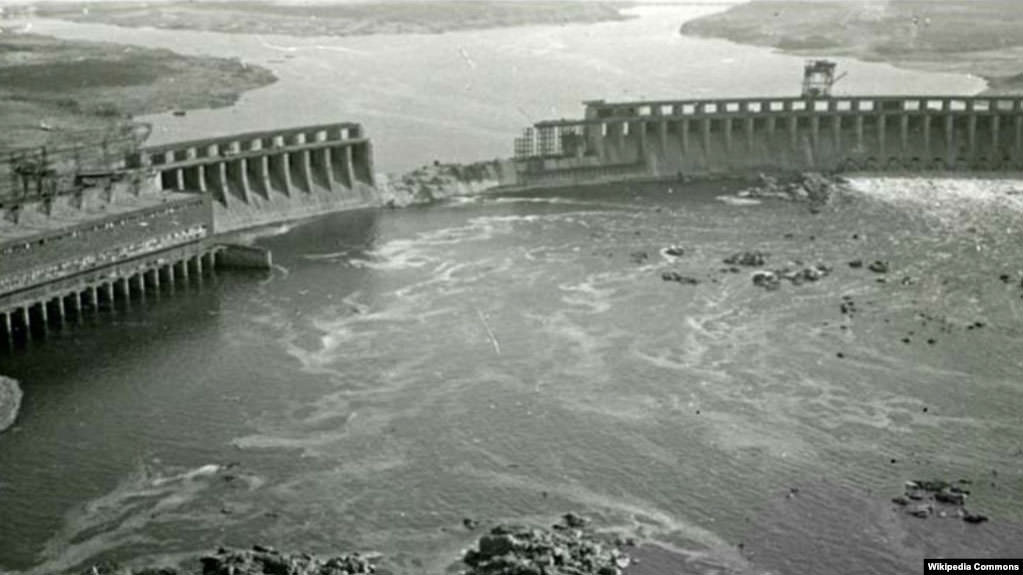

On August 14 of that year, Stalin reacted to the Nazi blitzkrieg roaring across the Ukrainian steppe by ordering the KGB’s predecessor, the NKVD, to dynamite the greatest dam on the Dnieper. This did more than interrupt the German advance. An unannounced wall of water swept down the valley, drowning tens of thousands of Ukrainians and some 2,000 Soviet troops in the Dnieper delta. The dam was swiftly rebuilt, and just as swiftly blown up again by the retreating Germans in 1943.

Zaporizhzhya Dam after its 1941 demolition by the NKVB.

Zaporizhzhya’s six reactors have just been captured intact by a column of Russian tanks and mobile artillery following a flare-illuminated night attack. As a result, Putin acquired a six-pack of up and running gigawatt reactors—a bookable 25-billion-dollar asset with an even higher replacement cost.

A more acute economic risk may dampen the invasion’s bottom line. One reason the Soviets retreated from Afghanistan in 1989 was the skyrocketing cost of lost aircraft. At the invasion’s height, the Soviets were justly proud of their air superiority—they had the world’s most formidable attack helicopters and knew how to use them. Their titanium armored helicopter gunships and attack aircraft could shrug off anything from AK-47 bullets to garnets shot as musket balls from antique jezails.

Asymmetrical warfare can be as much economic as tactical, and Putin is being reminded that now as in 1986, the world’s best combat aircraft come with staggering price tags–upwards of seventy million dollars for the top-of-the-line Sukoi 35 fighter bombers now attacking Kyiv.

In the Reagan years I advocated giving the Afghan resistance three things. Simple video gear to make the invaders as liable for on-camera atrocities as bad cops with body cameras, cheap but bullet proof Kevlar cloth, and America’s latest surface-to-air missile. With both ultraviolet and infrared imaging detectors, the Stinger of that era was not easily distracted by countermeasures and as often as not chased down its acquired target and blew a hole in its engine.

The downside was that this lethal weapon cost a hundred thousand dollars a shot. Many in Congress thought it as dangerous as it was expensive, for in the wrong hands it could down a civilian airliner as easily as a military helicopter. That view was overridden by Texas Democrat Charlie Wilson.

In 1983 he boosted the black budget of the CIA’s Operation Cyclone, earmarking $17 million for MK72 Stingers to shoot down Mi-24 Hind helicopters. In 1984 the agency asked for and got a further $50 million, and $300 million of unused Pentagon money was transmuted into enough to rival the number of Soviet aircraft in Afghanistan. As those aircraft had inflicted heavy civilian casualties, the Mujaheddin began to use the Stingers with a literal vengeance – Soviet air losses trebled in three years. An invasion intended to pay for itself via Afghan resource exports started hemorrhaging billions of rubles as aircraft losses rose.

A replay is in the offing in Ukraine, which has received more new MK73E7 Stingers than the Russians have attack helicopters. The AI-tinged microprocessors of this third-generation hardware reportedly deliver 90% lock-on lethality. Just as American Javelin and British NLAW anti-armor missiles slowed the invasion’s tempo by clogging its arteries with the carcasses of 200 tanks and uncounted trucks and armored personnel carriers, the up to date Stingers, together with Polish (and Russian!) portable surface-to-air missiles have forced the revision of the invaders’ operational air war.

Putin’s territorial ambitions have some basis in the universal desire for strategic depth. European borders defined by features of the landscape have trumped straight lines drawn on maps since the days of the Roman limes, and, as with post-colonial Africa, Russia knows the risks posed by arbitrary and physically undefined borders.

Like the Rio Grande or the Rhine, the Dnieper has a place in cultural history as a signifier not just of division, but regional integration. Rivers have bridges on both banks, and mental and political maps may gain stability from permanent features of reference. For four thousand years Kherson has stood at the Dnieper’s mouth. The Chersonese coast is literally the stuff of legend–a place the Argonauts sailed by. It’s down east from Constanta, where Ovid was exiled, and downstream from where the Varangian Vikings first knit together the economies of Moscow, Kiev, and Constantinople. If Putin wants to declare victory before he gets too many legions killed, he’s already picked up enough territory to claim a triumph.

With Cherson, the harbor cities of the Sea of Azov, and Sevastopol’s naval base already in hand, Putin has scant need for another strategic port like Odessa. Having consolidated Russia’s place as a European energy hegemon—his new coastal conquests come with vast offshore gas and oil reserves—he could declare victory and leave a divided Kiev standing, still the capital of a nation large as Germany. The re-partition of Ukraine along the Dnieper by Putin might not register in Russian annals as a restoration of Empire, but it would leave the KGB’s favorite son free to imagine himself astride an equestrian statue or two, riding into the sunset and a safe place in Russia’s schoolbooks. which is a lot better than Feliks Dzerzhinsky ever did.

His Black Seaboard gambit makes more sense considered as a game of go rather than chess. The 2014 annexation of Crimea was the first stepping-stone up the Dnieper. He’s already turned the Sea of Azov back into a Russian lake and seized the river’s most important renewable energy assets. What more could he want? The Great Steppe is a profoundly Russian landform, and the Dnieper demarcates its western edge. If Moscow once again controls it, the partition of Kyiv could become a likelier outcome than its wanton destruction. It wouldn’t take a Berlin Wall to divide the Ukrainian capital. A river runs through it.

The Dnieper flows quiet as the Don and wide as the Hudson though downtown Kyiv. With his forces already controlling much of the East Bank, seizing the rest is, like it or not, something Putin might get away with, for nature created a strategic divide by carving the Dnieper into the Ukrainian landscape at the end of the last Ice Age.

Nothing so substantial stood in the way of the Warsaw Pact when Germany reunited, but that event failed to send tanks rolling, or ICBM’s flying. Such is the force of nuclear deterrence that, great as it looms as a human tragedy, the prospective loss of half the Ukraine is not a plausible casus belli. John Mearsheimer has noted that Crimea’s re-annexation was spearheaded by troops from a Russian base in Sevastopol, held, rather like Guantanamo Bay, under a very long-term lease. It follows that seizing the Ukraine east of the Dnieper would not move Russia’s border any closer to a NATO member than it already is. That dubious sub-strategic distinction already belongs to the short stretch of the Black Sea separating Rumania from the Crimea, whose Russian reconquest in 2014 failed to trigger Article 5 of the NATO treaty.

This leaves a dilemma. Well-justified as the anger of the Ukrainians and the indignation of the world at this murderous incursion may be, starting a land war in Asia against a nuclear power is not a fiduciary option.

So, what is to be done? The protective services surrounding Putin and Zelensky are as vigilant as the lines of headhunters queued up behind Senator Graham and the Wagner Organization are long, but nobody has the back of the millions of Ukrainian men, women and children literally driven underground as the first drops of hypersonic rain streak down from the skies of the first war of the future.

Russell Seitz

Fort Lauderdale, FL

March 2022

“The wheels of justice grind slowly….”

To the Editor,

The House Select Committee on the January 6th attack on the Capitol was formed on July 1, 2021, almost 6 months after the insurrection took place. The DOJ and Attorney General Merrick Garland began their investigations much earlier, yet we are still waiting to learn if the instigators and planners of the attack will be charged and indicted and, just as important, that the events preceding the election and subsequent to it, amounting to federal offenses (interfering with election-results), are also investigated by the DOJ. This assault on our democracy did not take place in a vacuum, it was demonstrably and meticulously coordinated by Trump and his cohorts, and they must be held accountable.

It is commendable that finally – on January 13 – indictments were handed down on charges of seditious conspiracy against 11 of the attackers (mostly members of the Oathkeepers). This development changes the dimensions of the offense – but where are the indictments against Trump, and those members of Congress and the military who were involved as instigators and planners of the attack, as well as the perpetrators of other federal crimes such as the coercion of State election officials and the submission of falsified voting records?

It is also encouraging to note that the Atlanta prosecutor was recently granted her request to seat a special grand jury to review charges that Trump attempted to interfere with the election results in Georgia.

And in Michigan, the Secretary of State, Jocelyn Benson, has now provided Bennie Thompson, Chair of the House Select Committee, with more potential election fraud incidents in that state, equipping the committee with additional material to further investigate and share with the Justice Department.

These crimes cannot go unpunished, it is essential that we signal to the perpetrators and those who would follow in their footsteps that they cannot break our laws, violate our constitution and threaten our democracy with impunity; and it is therefore just as essential that the investigations and ensuing indictments should be executed in an expeditious manner in order to have guardrails in place before the next election.

Ursula Lahat

Los Angeles, CA

To the Editor,

I recently read the article “Changes in the Electorate Signal Close Florida Race” by Karen Houppert. She repeatedly used the term “Latinx” to, I assume, describe people of Latin American heritage. I understand that she wants to be as “woke” as possible, but to use a meaningless word is unacceptable. The proper English word is Latin or Latin American. Spanish is a gender based language (as are all romance languages), so if you are going to use the language then use it properly. My wife is a Venezuelan-American and can’t stand how “woke” people abuse her native language.

Frederick Dennstedt

Flagstaff, AZ

To the Editor,

This afternoon I’ve been listening to the impeachment trial with tears in my eyes for several reasons. The first is because of the thorough and deeply researched history lesson that the Democratic House managers are providing in the proceedings. It is not fine oratory but it is compelling and you can hear the passion in their voices. What an example for our offspring, in place of the pathetic administration currently in power.

Further while listening one realizes how much our country has sunk into a quagmire of corruption and venality. It takes a very large hit to the stomach to make this tough old broad tear up, but this whole presidency has been just that: a very large kick in the belly. Many, many people whose opinions and thoughts I appreciate and value, feel the same. It isn’t a simple case of I don’t like the man, it is the totality and coalescing of every facet of him and his administration into a malignant whole.

If you aren’t binge watching on TV (I’ve been listening via WCAI) – please try to catch at least some of the proceedings. You can probably also catch the whole thing on your own version of NPR as well. Go to npr.org. It is well worth the time and effort to find even just a small portion. It is a demonstration of democracy and an explication of the Constitution at its best, compared to the dismissive GOP responses, which are an exhibition of partisan politics at their worst. Even if you do not share that opinion, you must at least agree that the way that Mitch McConman is structuring the proceedings is shocking.

Virginia Jones

West Tisbury, MA

To the Editor,

I am not sure why Steve Pressman wrote, and you published, such a lame set of arguments against a wealth tax (Sep 1 issue, p 6). The article claims “Perhaps the biggest negative is that the wealth tax does not have a very distinguished history.” The main historical fact reported is that some wealth taxes were repealed, or reduced, or were unpopular as evidenced by their decline. So what? In general, many progressive policies have been rolled back recently: fewer OECD countries had wealth taxes in 2000 than in 1990. Should we conclude the policies were a bad idea? Wouldn’t it be more reasonable to conclude that the coincidence of the repeals and increasing wealth concentration shows they were a good idea?

Despite the reference to the historical record, and the flat assertion that the “an annual tax on wealth has far too many drawbacks to be effective” at the conclusion, the only empirical part of the article

is the dubious interpretation of history discussed above. The bulk of it consists of speculative arguments about possible drawbacks of a wealth tax. The author seems to want us to confuse his speculation with fact.

The article fails to note the US has wealth taxes right now, namely property taxes. I wonder how that’s possible if wealth taxes are unpopular and unworkable?

The article also omits most arguments for a wealth tax. I’d like to suggest one: we are in a period of massive transfer of wealth upward. There are many culprits: government policies that weakened most worker’s negotiating position by weakening labor law and maintaining unemployment to fight inflation; patents and monopolies (drugs, software, media); direct government subsidies such as the Fed’s giving banks cash for their nearly worthless securities in the last financial crisis; energy companies that paid nothing for wrecking our planet.

Further back, the labor and wealth of Africans has been systematically looted. We sit on land conquered from native people or Mexicans. Ordinarily the remedy for a crime would be to undo it and return the money. But little of what happened is amenable to such a remedy. A wealth tax is the next best way to right the wrongs.

Ross Boylan, Ph.D.

San Francisco, CA

Pressman responds:

First, and maybe most important, property taxes are not wealth taxes. The property tax is a tax on the assessed value of a home and the land it sits on. It is not a tax on the equity that one has in one’s home, which would make it a wealth tax. The same property tax applies to someone underwater on their mortgage and someone who owns their home outright — when the two homes are of equal value in the same neighborhood. Rather than a tax on the wealthy, property taxes fall primarily on the middle class. As Edward Wolff (the expert on this issue) has documented, these are the people who have the largest majority of their wealth in home ownership. The rich have the vast majority of their wealth in the form of financial assets, which escape the property tax. If we want to tax the rich, a financial transactions tax would be a much better alternative (for more on this, see my article in the October Washington Spectator).

Second, I don’t disagree that wealth and income inequality have increased greatly in the US over the past 4 decades. This is supported by a great deal of empirical evidence. And, as some of my own work documents, things are even worse than what the standard data shows. However, the lack of a wealth tax is not responsible for this, as the US has not abandoned (or lowered) its wealth tax while inequality began its steep ascent (as we have no wealth taxes). You did mention one important cause of rising inequality in your comment — the reduced power of labor. Missing from your list of causes are two extremely important things — lower top income tax rates and the even lower tax rates for income received from owning wealth (beginning in 1980, when the great rise in inequality began).

Finally, while I agree that the inequality problem needs to be solved, and that we need to tax the rich; but we need to do it in the right manner. There is no point in focusing on options (like the wealth tax) that are neither a cause of the problem nor likely to solve the problem, given centuries of historical experience with wealth tax (including the window taxes in England, which I discussed in my September Washington Spectator piece). The right response to rising inequality seems to me to go back to where we were before Republicans began slashing income taxes for the wealthy. And we can deal with the accumulation of wealth by taxing the transfer of wealth (at death), either with an revived estate tax or with an inheritance tax. I will be discussing these issues in greater detail in the Washington Spectator soon.

Steven Pressman