In September, Chinese President Xi Jinping announced a carbon cap-and-trade program to reduce greenhouse emissions, delivering on a bi-national agreement he reached with President Obama in November 2014. The United States and China together account for one-third of global greenhouse emissions. In the United States, the process of reducing emissions to the agreed-upon 25-28 percent below 2005 levels by 2025 began with Environmental Protection Agency rules released in August 2015. The EPA “Clean Power Plan” is being challenged in federal court by 17 Republican governors and state attorneys general. In Congress, Republicans in both chambers, most of whom deny anthropogenic climate change, have blocked all attempts to enact restrictions on greenhouse gas emissions. Despite Republican obstruction, many corporate executives and investors in the United States are moving forward on climate change, with executives implementing greenhouse-gas reduction programs and investors weighing the risks of investing in energy-inefficient companies.

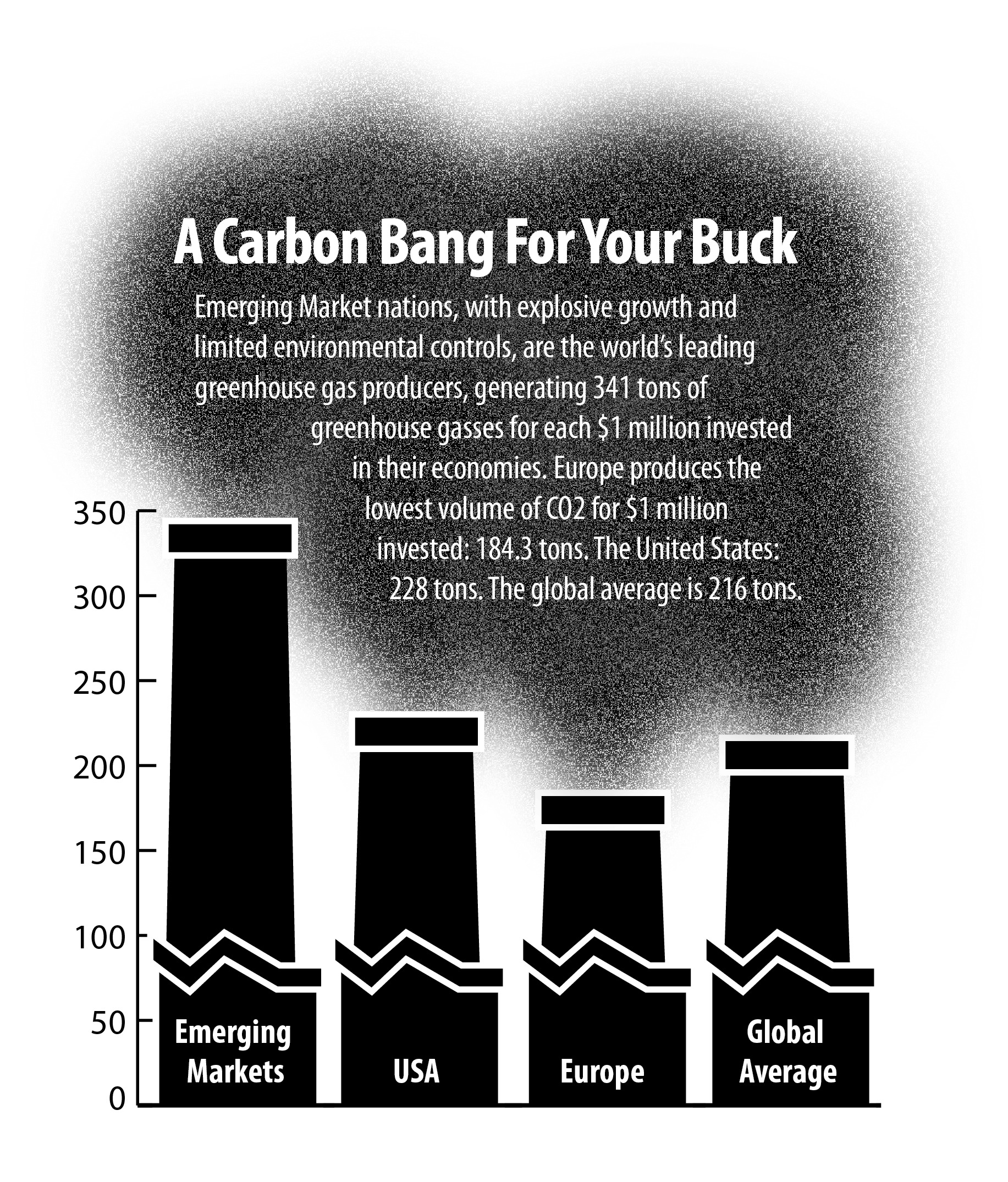

Non-profits such as the Climate Disclosure Project are enlisting corporations in a program by which, as a fiduciary responsibility, they voluntarily list climate-change information in quarterly and annual reports and sign on to carbon-reduction programs. For-profit companies are marketing investment analysis that identifies assets classes, sectors, and countries in which investment results in lower greenhouse-gas emissions. MSCI, a private firm that provides market research to institutional investors, recently published an index of its measurement of tons of emissions per $1 million invested in specific world markets. MSCI’s metrics provide insight into who is heating up the planet. Emerging markets, led by China, India and Brazil, with explosive growth and limited environmental regulation, are the biggest greenhouse-gas producers. European nations are the lowest.

0 Comments