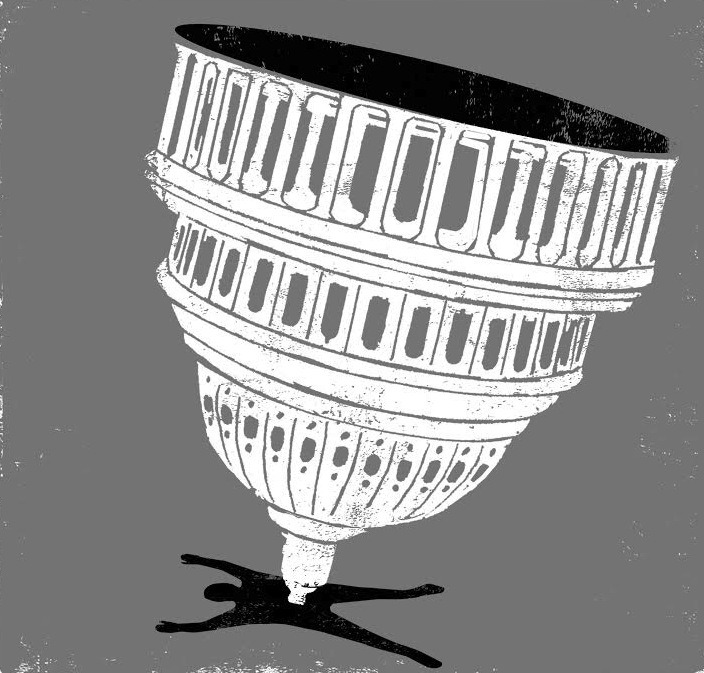

Government policy is the wedge dividing the very richest from everyone else in America. The gap between the have-mores and have-nots will narrow and widen now and then as the economy contracts and expands, but over the long run, this chasm will become ever wider unless we change current government rules.

As Eric Schneiderman, the New York state attorney general, cogently observed, “The distribution of wealth is not determined by nature. It is determined by policy.”

The good news is that just about everyone understands that extreme inequality is a problem. Even Standard and Poor’s, the Wall Street ratings agency, got around to saying this year that inequality is so severe that it retards economic growth.

The bad news is that the reasons for extreme inequality, how it was created, how it is perpetuated and what we can do about it are understood by very few. In Divided: The Perils of Our Growing Inequality, we try to give meaning to these policy shifts and to inform people about what can be done, vital first steps before our democracy can shift gears and move to correct a dangerous imbalance.

How dangerous? According to Stephen Bezruchka, a physician and public health teacher: every day in America 47 infants die who would live if they were born in Sweden, which has better health care and better public health.

Getting the Concepts Right

We often talk of trickle-down economics, the derisive Democrats conceived three decades ago to belittle Reaganomics. But trickle down is the wrong concept—and it fails to inform people of reality. There was no trickle down under Reaganomics; there was only Niagara up.

We often talk of trickle-down economics, the derisive Democrats conceived three decades ago to belittle Reaganomics. But trickle down is the wrong concept—and it fails to inform people of reality. There was no trickle down under Reaganomics; there was only Niagara up.

Anyone who paid attention to Ronald Reagan’s 1980 campaign should have been able to grasp this. Reagan wanted wealth creators to enjoy more of their income. They did not, because high tax rates encouraged reinvestment of profits in business rather than taking out enough to finance not just a grand but ostentatious lifestyle.

With Reagan’s lower tax rates in effect, we have seen the proliferation of multi-mansion families, his-and-her private jets and objets d’art commanding more than $100 million at auction. When rich business owners buy such baubles, they are inherently destroying jobs as they remove capital from their businesses rather than using it to expand, pay better wages or increase dividends to investors.

The reason the richest of the rich are enjoying such immense incomes is not because they suddenly got smarter and built better mousetraps. And it certainly is not because the vast majority all decided to become slackers.

It is because of government policy.

Taxes, though, are just one part of government policy driving extreme inequality.

These policies are in effect barriers to success and they abound.

Congress and the courts have taken away economic power from workers under policies begun by Reagan, the only union president to become a United States president. Our leaders handcuffed tax auditors, job-safety inspectors, public-health workers and others—all of which amount to a huge but subtle subsidy to tax cheats, reckless business operators and others who act with often-callous disregard for their fellow Americans.

Federal and state regulatory boards are packed with industry officials and only a token, and usually very weak, consumer advocate here and there.

Worse of all, in myriad, but oh-so-subtle ways, government helps big business drain your pockets and destroy competition from family-owned enterprises. It subsidizes big-box retailers and national hotel chains to the detriment of locally owned businesses. It lets nearly 3,000 corporations keep the state income taxes withheld from worker paychecks without letting workers know the boss is taxing them.

It is crucial to understand that there is no grand conspiracy, no one-policy goal here.

Instead, like the stalactites hanging from the ceilings of ancient limestone caves and the stalagmites below them, these policies come from the steady drip, drip, drip of official favors. These changes occur quietly—one rule, one exemption and sometimes just one word (as when “shall” is replaced with “may”) at a time.

You will not read about these rules in the mainstream press except on rare occasions, and then with little or no context. Like the creation of those amazing caves, these policy changes are a mystery to most Americans.

Inequality Explained

Inequality is not synonymous with poverty.

Inequality is about the distribution of resources.

By income, the top 1 percent start at about $360,000. But half that group makes less than $500,000. The groups that really bring home the bacon are much higher up the income ladder.

The top tenth of 1 percent—that is one in 1,000—starts at about $2 million. These 300,000 Americans enjoy more income than the bottom 140 million.

The 1 percent of the 1 percent, a group in which Mitt Romney is near the bottom, starts at around $10 million of annual income and reaches into the billions of dollars for a single year.

To get an idea of how well those at the very top have done, consider the change between 1966 and 2011 in the average income of the bottom 90 percent compared to the top 1 percent of the top 1 percent.

The bottom 90 percent, in 2011 dollars, enjoyed just $59 in greater inflation-adjusted income per household at the end of this 45-year period. Let’s imagine we are creating a graphic and the line for $59 is one inch high.

The line for the 1 percent of the 1 percent will be five miles.

I would explain the ratio for 2012, but mathematically it will not work. The vast majority in 2012 averaged just $30,997, a few dollars less than in 1966.

So how did the top 1 percent of the top 1 percent fare? From 2011 to 2012 their income soared by a third from $22.3 million on average to almost $31 million.

The wealth divide, as opposed to the income divide, is much greater.

In 2010, which was not a great year, the top 1 percent started at $8.4 million net worth, the Census Bureau estimates. And it’s worth remembering that, by definition, most great wealth is in the form of untaxed capital gains—money that will never be taxed if the estate tax is repealed, allowing accumulated wealth to be passed on, untaxed, to heirs.

An early Divided chapter is a speech that President Barack Obama gave in 2011 in Osawatomie, Kansas. In it, he channeled President Theodore Roosevelt, who gave a major policy address in the same small town in 1910. Roosevelt, born to the manor, said:

Conflict between the men who possess more than they have earned and the men who have earned more than they possess is the central condition of progress. In our day it appears as the struggle of freemen to gain and hold the right of self-government as against the special interests, who twist the methods of free government into machinery for defeating the popular will.

Now here is President Obama 101 years later, saying that market capitalism has:

led to prosperity and a standard of living unmatched by the rest of the world. But Roosevelt also knew that the free market has never been a free license to take whatever you can from whomever you can. He understood the free market only works when there are rules of the road that ensure competition is fair and open and honest. And so he busted up monopolies, forcing those companies to compete for consumers with better services and better prices. And today, they still must. He fought to make sure businesses couldn’t profit by exploiting children or selling food or medicine that wasn’t safe. And today, they still can’t.

Those last parts, about monopolies and rigged markets and unsafe food and exploiting children are not things of the past. They are with us today. They are much more deeply entrenched now than in Teddy Roosevelt’s time.

And they are at the heart of why we have become a nation that in terms of income and wealth is so deeply divided.

Obama never came close to Roosevelt’s call to break up monopolistic trusts and leveling the playing field so America as a whole could prosper. Can anyone imagine Obama saying these words voiced by Republican Roosevelt?

At every stage, and under all circumstances the essence of the struggle is to equalize opportunity, destroy privilege, and give to the life and citizenship of every individual the highest possible value both to himself and to the commonwealth. That is nothing new.

It is, instead, something so old the mainstream reporters missed that Roosevelt swung a big stick, while Obama swings his golf club at courses open only to the privileged.

Obama does not break up monopolies; his administration raises tepid questions around the edges of anti-competitive mega-mergers, like the pending Comcast takeover of Time Warner Cable. He promotes not universal health care that would lower costs, but reinforces the power of the superfluous but highly profitable health industry.

Obama’s first attorney general coddled corrupt Wall Street bankers, failing to prosecute them for mortgage and securities fraud, conspiring with tax cheats and klepto-dictators, and not even for laundering billions for drug traffickers. Fines and promises not to do it again are all Obama stands for. Indeed, no Obama appointee will even speak with Bill Black, the banking regulator turned criminologist whose diligence produced more than 3,000 felony convictions in the savings and loans scandals a generation ago.

Imagine how different America would be if Obama and everyone seeking to be the next president worked to destroy privilege, make property the servant not the master, to make sure workers get paid fairly. Imagine if just one of them would say, as Roosevelt did to a crowd of tens of thousands in Kansas “that every man holds his property subject to the general right of the community to regulate its use to whatever degree the public welfare may require it.”

David Cay Johnston, an investigative reporter who won a Pulitzer Prize, teaches business, tax and property law of the ancient world at the Syracuse University. His most recent book is an anthology, Divided: The Perils of Our Growing Inequality.

Fundamentally, David Cay Johnston has effectively documented that the system is broken, and is rigged to economically benefit the wealthy ownership class (although Johnston never refers to the word OWNERSHIP). Concentrated wealth-creating, income-producing capital ownership is at the heart of the problem of economic inequality.

While Johnston performs a great service by defining the extent of economic inequality, he does not offer any solutions. Nor has there really been any offered by those stuck in the one-factor world of thinking that the ONLY way to earn income is through a JOB. This is why with every proposal, whether by Republican or Democrat or other political party policies makers, the component that justifies the economic policy is JOB CREATION. Yet there is NEVER a discussion which addresses who will benefit from the ownership of the economic scheme. What we need are policies and rules that will unite America, reform the system, and empower EVERY citizen to benefit economically from owning expanding shares in the corporations that are growing the economy.

Johnston points underscore just how inadequate our corporate and tax policies are, and how our priorities are wrong. The rich are getting richer through constant capital ownership accumulation aided by government policies and rules that extend huge tax breaks for corporations with no stipulation for broadening ownership of America’s corporations. Driven by the Republican Party, whose mantra is to protect corporate ownership concentration and profitability of those who presently OWN America––the wealthly capital ownership class, further reducing the corporate tax rate WITHOUT eliminating all tax loopholes and subsidies and the stipulation that all corporate profits by fully paid out as dividend earnings to the owners of the corporations will result in more unjust corporate ownership concentration and enrichment of the wealthy ownership class at the expense of the vast majority of working Americans stuck in the rut of wage slavery.

Of course, the call for lowing corporate tax rates is ALL in the name of JOB CREATION, and Republicans blame outsourcing and the loss of jobs on what they believe is a high nominal tax rate that American corporations pay. But if the Republicans and the Democrats and other political party policy makers really want to end investment abroad and job outsourcing, then why not completely eliminate the corporate income tax in exchange for paying out fully the dividend earnings to the owners of the corporation and replacing retained earning and corporate debt financing of economic growth (neither of which creates new capital owners) with the issuance and sale of new corporate stock that represents the to-be-formed physical capital assets that would grow the economy? This would refocus investment in American corporations who want to grow the economy in our homeland, result in the creation of new capital owners who would make up a broad corporate ownership base, effectively empower the new owners to own the “machines” that are destroying jobs and devaluing the worth of labor, and effectively stimulate REAL (not make-work) employment opportunities as we build a FUTURE economy that can support general affluence for EVERY child, woman, and man.

How can we simultaneously grow the economy and create new capital owners?

We will need to reform our broken system in which economic growth is hindered by the slavery of “past” savings. The denial of consumption or “past” savings has been the primary means necessary to financing economic growth. We need to adopt new policies to provide the necessary system reforms to abate the further concentration of wealth-creating, income-producing capital ownership and ensure that continual broadened capital ownership and corresponding wealth building occurs and benefits EVERY citizen as the economy expands.

The most significant system reform needed is to equally empower EVERY citizen, without the requirement of “past” savings or capital asset equities, to acquire personal ownership shares in FUTURE wealth-creating, income-producing capital asset growth. This can be accomplished using insured (facilitated with private capital credit insurance or a government reinsurance agency––ala the Federal Housing Administration concept), interest-free capital credit loans issued by local banks repayable out of the FUTURE fully paid out dividend earnings generated by profitable investments in the corporations growing the economy. This objective can be achieved with the passage of the proposed Capital Homestead Act.

A more comprehensive set of solutions can be found in the platform of the Unite America Party, a platform is offered for adoption, by any political party.

Support the Capital Homestead Act at https://www.cesj.org/learn/capital-homesteading/capital-homestead-act-a-plan-for-getting-ownership-income-and-power-to-every-citizen/ and https://www.cesj.org/learn/capital-homesteading/capital-homestead-act-summary/.

Support the Unite America Party Platform, published by The Huffington Post at https://www.huffingtonpost.com/gary-reber/platform-of-the-unite-ame_b_5474077.html as well as Nation Of Change at https://www.nationofchange.org/platform-unite-america-party-1402409962 and OpEd News at https://www.opednews.com/articles/Platform-of-the-Unite-Amer-by-Gary-Reber-Party-Leadership_Party-Platforms-DNC_Party-Platforms-GOP-RNC_Party-Politics-Democratic-140630-60.html.