The GOP Affordable Care Act replacement draft includes reforms promoted by Speaker of the House Paul Ryan since (and before) the passage of the ACA, including funding Medicaid with block grants to states and a per capita cap on Medicaid funding. The federal government pays a fixed share of states’ Medicaid costs.

Under Ryancare, federal funding would cover a fixed per capita amount and states would cover all costs above the cap—leading to an inevitable reduction in services. States would have to contribute significantly more, or more likely, cut payments to providers, as well as benefits. For example, 30 million children enrolled in Medicaid could lose access to comprehensive periodic medical screening that ensures that low-income children, particularly those with complex medical conditions, receive preventative care.

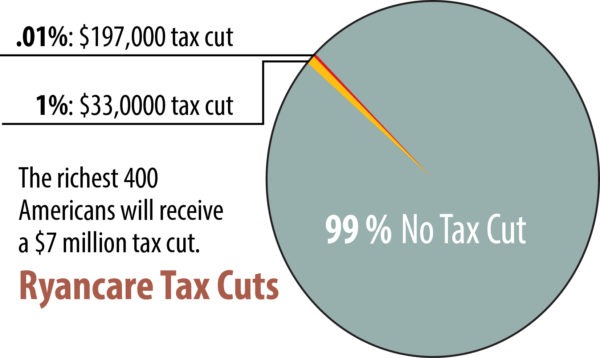

The bill would also revoke the Obamacare Medicaid expansion, which extended coverage for low-income Americans to 11 million additional people. The bill eliminates all taxes imposed by the ACA, correcting the “transfer of wealth” that undergirds “Obamacare.” As much as anything, it is a tax cut for the wealthiest Americans. Taxes for the top 1 percent of Americans would be reduced by an average $33,000 next year. The top one-tenth of 1 percent of taxpayers would receive an average $197,000 tax in break. And the 400 highest earners, averaging $300 million a year, would receive individual tax windfalls of $7 million.

0 Comments