With Covid-19 and Black Lives Matter foremost on everyone’s mind, it is unlikely that Social Security will play a prominent role in the 2020 election. Joe Biden and the Democrats should try to ensure it does. Focusing on Social Security works to their advantage.

One reason Donald Trump won the 2016 election was that he received a sizable majority of votes cast by those 65 and older. Currently, Biden is running ahead among this demographic. A surefire way to maintain this support would be to present a plan to improve Social Security. Another approach would be to emphasize that Democrats built the program and Republicans have repeatedly sought to dismantle it, despite its status as the most successful and popular government program in U.S. history.

Social Security turns 85 this month. Developed during the Great Depression, born during a period of dire economic circumstances, including double-digit unemployment, it was a feature of President Franklin D. Roosevelt’s New Deal.

Initially it was just a retirement program, providing income to those 65 and over without jobs. Roosevelt wanted each generation to save for its own retirement rather than taxing each generation to pay for the retirement of its parents and grandparents. He thought this would generate greater political support.

Social Security payroll taxes (so called because they apply only to wages or firm payrolls) were collected starting in 1937, and benefits were scheduled to begin in 1942. However, a problem surfaced—the tax contributed to a reduction in consumer spending. Unemployment spiked from 14 percent in May 1937 to 19 percent in June 1938. In response, retirement benefits began in 1940 and the system became pay-as-you-go—taxes collected now pay for current benefits.

Over the years, Social Security has grown. Benefits for spouses and children of deceased workers were added in 1939. Disability insurance was added in 1956, so that those unable to work would receive some income. Health insurance for the elderly (Medicare) was added in 1965.

In addition, benefits were increased regularly during the 1960s and early 1970s. Payroll taxes rose to fund these improvements. In 1973, Social Security recipients began receiving automatic cost-of-living adjustments, or COLAs. Each January, benefits rise with inflation recorded over the previous year, assuring retirees a minimum standard of living. As Social Security benefits increased, the poverty rate of Americans 65 and older dropped sharply—from 35.5 percent in 1959 (far higher than the national average) to 9.7 percent in 2018 (well below the national average).

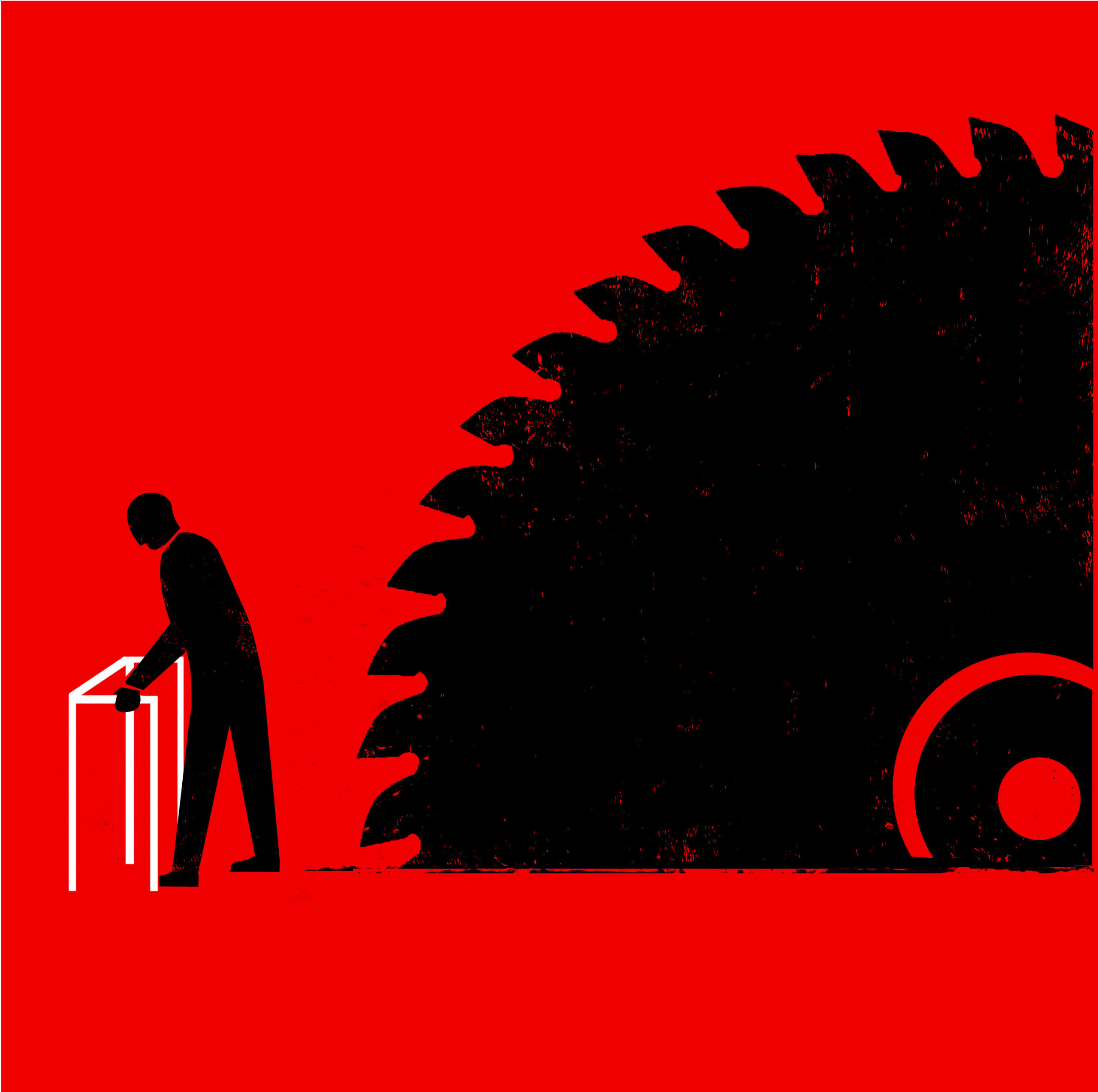

Still, Republicans have always perpetuated the myth that Social Security was on the precipice of bankruptcy, an eventuality that would lead to dramatic cuts in benefits for retirees. And their solution has always been the same—cut Social Security benefits. Surprisingly, no Democrat has pointed out that the Republican cure is exactly the same as their phony problem.

Since Ronald Reagan, virtually every Republican president has sought to gut Social Security. In most cases, benefit cuts have been covert in order to avoid any political backlash.

Soon after taking office, President Reagan formed a commission to make Social Security solvent when the baby boomers retired. This led to the 1983 Social Security Amendments that permanently increased Social Security taxes and gradually increased the retirement age to 67. The latter change, when fully implemented in 2027, represents a 16 percent cut in benefits for an individual collecting Social Security at 65.

During his second term as president, George W. Bush proposed that two percentage points of the Social Security payroll tax go into private accounts controlled by individuals (creating a version of 401k accounts). But with less money coming into Social Security, benefits would have had to be cut significantly. Facing enormous opposition, this plan went nowhere.

Running for president in 2016, Donald Trump promised that, if elected, he would never touch Social Security. Yet he has suggested benefit cuts to the program every year that he has been president. His 2021 budget proposes cutting disability insurance benefits, which is part of Social Security. And during the Covid-19 pandemic, he floated the idea of allowing people to receive lump sum payments now instead of future Social Security benefits. Deemed the “Eagle Plan,” it is effectively a payday loan from the government—a small sum of money now that you pay for dearly in the future. Fortunately, the Eagle Plan did not fly.

Finally, President Trump has held seniors hostage, refusing to support any coronavirus relief for them unless Congress cut the Social Security payroll tax. The tax cut would aid those currently employed but not retirees or the unemployed, who need money now for food and rent and to pay medical bills. It will also have an odious consequence—Social Security will appear to be a failed program, inching closer to insolvency.

This brings us to the 2020 election.

Republicans frequently suggest raising the age for collecting full benefits from 67 to 70. In practice, this means a 25 percent cut in benefits, or $375 less each month for an average Social Security recipient. Another Republican plan seeks to reduce or eliminate COLAs, thereby reducing the value of Social Security benefits each year. With 2 percent annual inflation, someone retiring at age 67 would see the buying power of their benefits fall around 25 percent by the time they reached 80, and 40 percent at age 90.

In contrast, Joe Biden has promised that, if elected, he would improve the finances of Social Security by taxing wages above $400,000. He should do more. The past four decades have been difficult times for average Americans. Household incomes have stagnated. People have gone deeper into debt to pay their bills; many have little savings and see no possibility of a secure retirement. Under such circumstances, Social Security needs augmentation.

Increasing the retirement age from 65 to 67 cut benefits by more than $200 each month. Several economists have proposed increasing monthly Social Security benefits by $200, returning them to their 1980 level. This would not be hard to finance, despite the longer-term financial difficulties now facing the Social Security program.

Pre-Covid-19, actuaries estimated that Social Security would run out of money by 2035. Forecasts suggested that the program would then be able to pay only 75 to 80 percent of promised benefits. The coronavirus surely will make things worse, as lost jobs and income reduce payroll tax revenues.

One reason for the problems facing Social Security is the retirement of the baby boomers. A larger reason is the sharp rise in inequality over the past several decades. With a greater fraction of total wages going to the rich, the income cap on Social Security taxes ($137,700 in 2020) reduces Social Security tax revenues. In addition, because wages fell from 64 percent to 58 percent of total income in the United States, while profits rose, the Social Security payroll tax yielded less revenue.

No economic principle requires that all retirement benefits be paid with payroll taxes. This is an institutional decision. Different nations fund their retirement programs differently. The United States can do so as well. Money can come from other taxes or from borrowing. A small tax on estates worth over a few million dollars, with the funds earmarked for Social Security, would help recover losses from rising inequality during the past several decades. Another possibility is to tax forms of income other than wages. And if it is acceptable for the federal government to borrow when Republicans cut taxes for the wealthy, it should be acceptable when providing retirement benefits to every American.

People understand that a Democratic Congress and President Biden would strengthen rather than dismantle Social Security. This is why Biden polls well with older Americans. As the election season approaches, Biden should channel his inner FDR, talk about expanding Social Security, and emphasize his sharp differences with Donald Trump on this issue.

Steven Pressman is professor of economics at Colorado State University, author of Fifty Major Economists, 3rd edition (Routledge, 2013), and president of the Association for Social Economics.

I pray we can overcome this idiot present.