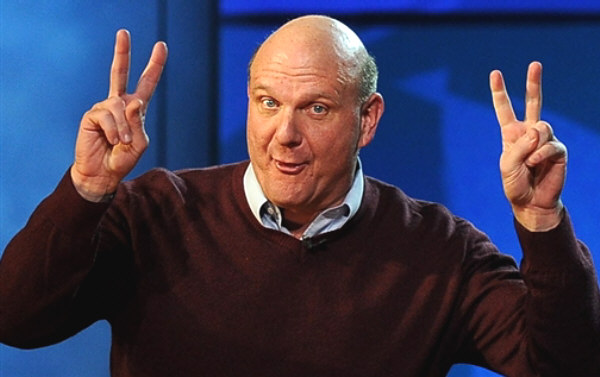

The news of Steve Ballmer’s planned retirement next year, announced last month, brought the Microsoft CEO’s critics out of the woodwork. He was widely skewered as the beneficiary of “the luckiest dorm-room assignment in history”—down the hall from Bill Gates when both were Harvard undergrads. Vanity Fair business writer Kurt Eichenwald called Ballmer’s watch at Microsoft the “lost decade.” The company stumbled badly, Eichenwald and other critics argued, on cutting-edge sectors like search engines, social networking, and mobile computing. Ballmer’s hated employee-ranking system, meanwhile, undermined teamwork, eroded morale, and inspired defections to Microsoft’s competitors.

| Over the last 30 years or so, income from ownership and control have jointly taken an increased share of the economic pie at the expense of ordinary workers’ incomes. |

Ballmer has his defenders as well. Some pointed out that the company’s total revenues and profits more than tripled during his tenure as CEO. Moreover, his annual salary and bonuses of a little over $1 million hardly compare to those of other executives at Fortune 500 companies. And he will not get a lavish retirement package like other CEOs—even those widely seen as failures—have enjoyed.(Most of his fortune comes from having joined Microsoft early and owning vast amounts of the company’s stock.)

Ballmer oversaw an unusually high-profile company—not many earn the moniker of “evil empire”—but as a story of CEO underperformance or overcompensation, it is far from egregious. CEOs at the largest U.S. corporations are routinely rewarded with high pay, bonuses, and stock options, largely irrespective of their performance.

When companies perform solidly or even spectacularly, the success is often credited to a genius CEO—rather than to the many other people who work there, general industry growth, or macroeconomic “boom” conditioins. In fact, however, there appears to be little or no relationship between the compensation of top executives and company performance (in terms of profits, stock price, etc.). As New Yorker columnist James Suroweicki put it a few years ago, lavish CEO compensation unrelated to actual performance amounts to a “heads I win, tails you lose” proposition.

This has not always been the case to anywhere near the extent it is today.

CEO compensation has increased from about 20 times the average for production and nonsupervisory workers in 1965, according to the Economic Policy Institute (EPI), to over 230 times today (down from over 350 times in the early 2000s). Nor is this a uniform phenomenon across countries (say, driven by new opportunities for worldwide expansion that only a superstar CEO can identify): In other high-income capitalist countries, the CEO-compensation ratio is far lower than in the United States.

Chief executives’ compensation is typically set by their boards of directors (or, most often, by a board “compensation committee”). Corporate boards are largely populated by top executives at other companies, who are likely to be generally sympathetic to high executive compensation. In some cases, the incentive for directors to support high compensation may be more direct—the CEOs of two different companies may serve on each others’ boards, and support high compensation for each other. In addition, the more other boards on which a company’s directors serve, economists Amir Barnea and Ilan Guedj have found, the higher that company’s CEO compensation is likely to be, the lower the correlation between CEO compensation and company performance, and the less likely the CEO is to be fired for poor performance. The explanation may be, as Barnea and Guedj suggest, that executives and directors who are connected through interlocking corporate networks “tend to take care of each other.” Or it may be simpler: Corporate directors who routinely support higher compensation may be more sought-after by CEOs for their own boards.

Economists David Gordon and Ian Dew-Becker conclude that CEOs are fundamentally different from “superstars” in fields like entertainment and sports, in that the CEOs “have a unique ability to control their own compensation.” The one limiting factor on CEO compensation, they suggest, is the “‘outrage constraint’ where shareholders retaliate if they perceive executive compensation to be excessive.” (This idea was proposed by economists Lucian Bebchuk and Jesse M. Fried.)

Is there no outrage, then, as there seems to have been little restraint on CEO compensation in recent decades? Part of the answer may be that shareholders—who presumably have the power to put their foot down on executive compensation—haven’t been the main parties harmed.

Corporate profits are now at near-record levels as a percentage of total income—and it is expectations of future profits that drive stock prices. So it is not stockholders that have taken it in the teeth as CEO compensation has ballooned.

Meanwhile, finance has captured a growing share of total income, in the form of both interest and financial-company profits. So the main story is that, over the last 30 years or so, all these forms of income from ownership and control have jointly taken an increased share of the economic pie at the expense of ordinary workers’ incomes.

Tails, you lose.

Alejandro Reuss is co-editor of Dollars & Sense.

0 Comments