Online propagandists and populist candidates have set their sights on a new enemy: Central Bank Digital Currencies (CBDCs). These currencies differ from private-sector cryptocurrencies like Bitcoin in that they are state-sanctioned and operated. Newly-expressed concerns over CBDCs augment long-running populist disdain for the Federal Reserve and other central banks.

Opponents of CBDCs cite the potential for government surveillance and control. They argue that if governments are able to monitor digital currency transactions, they can also use data about how people spend their money to develop social credit scores, cancel the funds of people targeted by the state, and exert control over society.

China, which introduced a digital Yuan in 2017, has been slowly growing its circulating supply, with about 13.6 billion CNY in digital circulation in December 2022, or about $2 billion USD — representing just 0.13% of cash reserves held by China’s central bank.

Critics say they worry that the United States will follow in China’s footsteps, and fan fears that Western nations may impose similar kinds of social control exerted by the Chinese Communist Party. They also suggest that US or European plans for CBDCs should be seen as efforts by China to exert political influence globally.

The latest campaigns against CBDCs began after President Biden issued Executive Order 14067, titled “Ensuring Responsible Development of Digital Assets” in March, 2022. The order directs several federal agencies to study the development of digital dollar assets within a framework that prioritizes consumer protection and stability, and to submit reports on “the future of money and payment systems,” from each agency’s perspective.

That deadline passed in December 2022, fueling speculation online.

Nellie Liang, Under Secretary for Domestic Finance of the US Treasury, speaking at an Atlantic Council event in Washington on March 1, 2023. (Source: Atlantic Council)

Fears that CBDCs pose an imminent threat have little basis in reality, however. Nellie Liang, Under Secretary for Domestic Finance of the US Treasury, outlined a detailed roadmap for exploration of digital currencies in March 2023.

Liang said, “In the United States, policymakers are continuing to deliberate about whether to have a CBDC, and if so, what form it would take. The Fed has also emphasized that it would only issue a CBDC with the support of the executive branch and Congress, and more broadly, the public.”

Additionally, she suggested that plans for a “retail” CBDC, held by individual members of the public, were less likely to be introduced than a “wholesale” product designed to augment interbank-transfer functions.

Speaking of a retail CBDC, Liang said, “If one were created, it would best serve the United States by being “intermediated,” meaning that the private sector would offer accounts or digital wallets to facilitate the management of CBDC holdings and payments. In terms of technology, a retail CBDC might involve a different architecture compared to a CBDC that is intended solely for wholesale use.”

Liang’s remarks suggest that any retail-facing CBDC would only be developed and introduced with the explicit backing of Congress, and that the public would continue to use banks as intermediaries. In short, nothing would change for end users, and any concerns over seizure of funds, surveillance, or social credit scoring are misplaced. There is no way to implement such schemes without a retail CBDC used directly by end users, what Liang describes as “a digital liability of the central bank that is accessible to the general public.”

Missing in the arguments from those concerned about the potential for CBDC’s to result in excessive surveillance and control is any discussion of how private-sector companies already sell and use such data in ways that are mostly unregulated and poorly understood, a phenomenon documented in books such as Surveillance Capitalism by Shoshanna Zuboff.

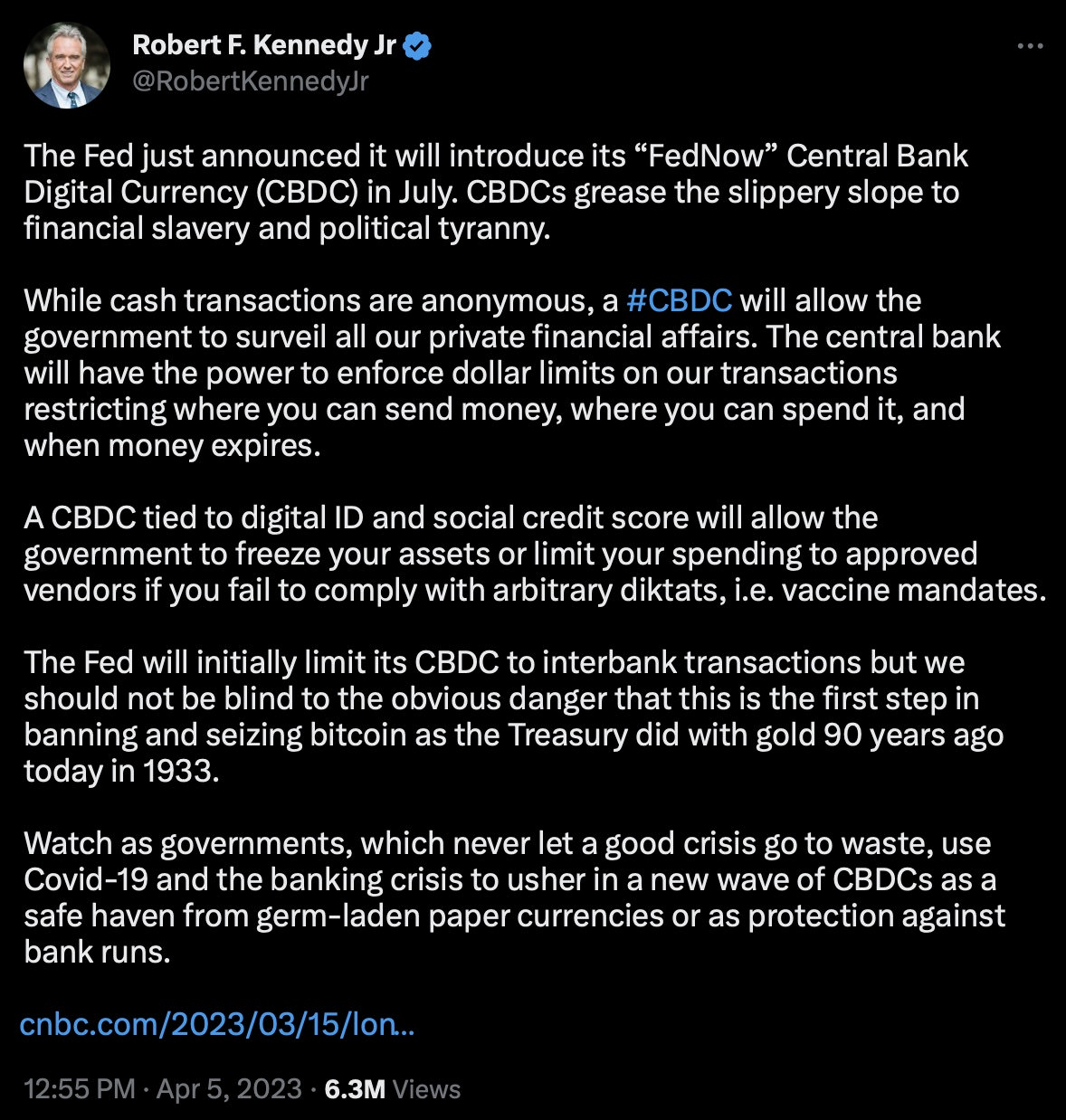

Robert F. Kennedy, Jr., who has announced he will run for president in 2024 as a Democrat against Joe Biden, has joined Lt. Gen. Michael T. Flynn and Florida Governor Ron DeSantis in stoking alarm over CBDC’s. Kennedy, who is also a prominent anti-vaccine activist, recently raised concerns over the Federal Reserve’s new “FedNow” product, scheduled for launch in July 2023.

The “FedNow” program, introduced by the Federal Reserve in August 2019, is not a CBDC, a digital currency, or any kind of cash replacement. According to Politifact, “The FedNow Service is an instant payment infrastructure developed by the Federal Reserve that will let businesses and individuals send and receive instant payments ‘in real time, around the clock, every day of the year.’”

But Kennedy suggested on Twitter without evidence that “FedNow” was a slippery-slope that would lead to the eventual implementation of social credit scores. “A CBDC tied to digital ID and social credit score will allow the government to freeze your assets or limit your spending to approved vendors if you fail to comply with arbitrary diktats, i.e. vaccine mandates,” he wrote.

“We should not be blind to the obvious danger that this is the first step in banning and seizing bitcoin as the Treasury did with gold 90 years ago today in 1933,” he added, baselessly referring to Roosevelt’s Executive Order 6102 which outlawed the possession of gold. (See: Paranoia on Parade.)

2021 Instagram post by vaccine skeptic Charlene Bollinger; from left-to-right: former National Security Adviser Michael Flynn, Robert F. Kennedy, Jr., Bollinger, and political strategist Roger Stone. (Source: Associated Press)

According to Robert Costa, a reporter for CBS News, Republican strategist Steve Bannon encouraged Kennedy to run against Biden as a spoiler in the 2024 race.

Florida Governor Ron DeSantis, a Republican presidential candidate, has also spread unfounded CBDC conspiracy theories, going so far as to introduce legislation to block their implementation in the state of Florida. A March 20th press release accompanying the legislation said, “The Biden administration’s efforts to inject a Centralized Bank Digital Currency is about surveillance and control.”

“Today’s announcement will protect Florida consumers and businesses from the reckless adoption of a ‘centralized digital dollar’ which will stifle innovation and promote government-sanctioned surveillance. Florida will not side with economic central planners; we will not adopt policies that threaten personal economic freedom and security,” the release continued.

A day after DeSantis’ announcement, Senator Ted Cruz (R, Texas) also proposed legislation prohibiting the Federal Reserve from establishing a CBDC, contrasting them with private, decentralized solutions like Bitcoin. Sen. Cruz said, “The federal government has no authority to unilaterally establish a central bank currency. This bill goes a long way in making sure big government doesn’t attempt to centralize or control cryptocurrency and instead, allows it to thrive in the United States.” These comments run contrary to Liang’s stated plans to only study the question, leaving all authorization for any possible implementation in the hands of Congress.

Michael Flynn’s recent rallies share the same title and themes as a 2022 book by Russian geopolitical strategist, Aleksandr Dugin.

Lt. Gen. Michael Flynn has placed CBDC’s at the center of his “Great Awakening vs. Great Reset” rallies, held throughout the country. Flynn and other speakers suggest that Biden’s digital asset order is integral to the “Great Reset” strategy proposed by the World Economic Forum leader Klaus Schwab. (It at least notable that Flynn’s rallies carry the same title and themes as a 2022 book by Russian geopolitical strategist Aleksandr Dugin.)

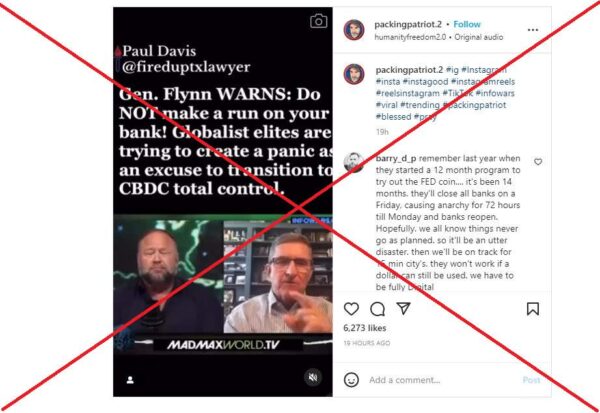

A March 12, 2023 Instagram post featuring Alex Jones and Michael Flynn sparking concern over CBDCs.

An Instagram post featuring Flynn with conspiracy theorist Alex Jones said, “Global elites are trying to create a panic as an excuse to transition to CBDC total control,” suggesting that the March collapse of Silicon Valley Bank could be used as a pretense to introduce oppressive currency schemes.

Other versions of the conspiracy theory suggest that paper money will be banned, again citing Roosevelt’s 1933 Executive Order that outlawed gold. No such proposal is currently in place, and according to Liang’s recent statements, the Treasury would not pursue any such strategy without approval of Congress.

Politifact previously debunked similar claims about the FedNow service, writing “[FedNow] is not a central bank digital currency, and it is not replacing paper currency. We rated False a similar claim in September 2022, reporting that FedNow will not require banks to turn over all physical currency.”

These various conspiracy theories attempt to add, without evidence, central bank digital currencies to the pantheon of existing populist bogeymen (which includes the Federal Reserve, shadowy globalist central bankers, and the Chinese Communist Party) in what amounts to a recapitulation of the paranoid fears stoked by the forged 1903 anti-Semitic disinformation pamphlet “Protocols of the Elders of Zion.”

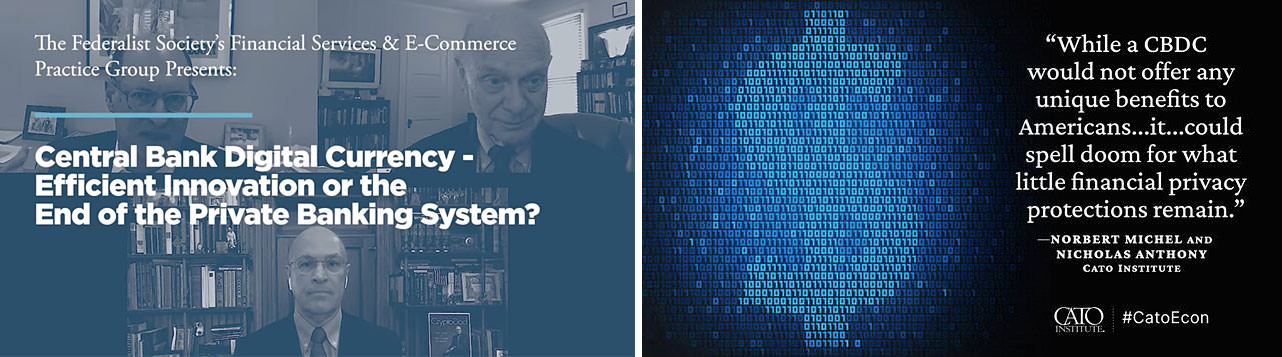

Conservative organizations the Federalist Society and Cato Institute are pre-emptively opposing CBDCs.

(Sources: Federalist Society; Cato Institute)

The Federalist Society and the Cato Institute have both come out against CBDCs, portraying them as a near-term threat and an instrument of imminent authoritarian control, despite the fact that, according to Liang, no implementation plan exists in the United States at this time.

Populist political technologists like Bannon and Flynn have engineered a full-spectrum attack that deploys fears over CBDCs across both the left and the right. Robert F. Kennedy, Jr. may carry some appeal to people on the left who venerate his family’s legacy, while Ron DeSantis can attempt to energize the right with the same anti-CBDC messaging.

Donald Trump speaking at Mar a Lago, April 3, 2023.

Donald Trump, recently indicted on 34 felony counts for falsifying business records, said during a post-indictment press conference that the “US dollar is crashing and will no longer be the world standard, and will be our greatest defeat in over 200 years,” another talking point popular with critics of CBDCs. Some online conspiracists also assert that Trump’s indictment was meant to serve as a distraction from the steady advance of a secret Biden CBDC agenda.

Fantastical theories about CBDCs and how they may be developed have diverged from reality, which, if officials decide to pursue the concept at all, will involve slow development and deployment after careful deliberation by both Congress and the Treasury.

But in the modern American political arena, outcomes are often influenced if not actually determined by those best able to play on the fears of the public, justified or not.

Seems like the Fascists are so bereft of ideas that they are reviving the classics, Jackson’s war on a national bank.